2024 was a pivotal chapter for the UK dental market, marking a transition toward a...

Pricing trends in the UK dental market

.png?width=910&height=641&name=DMR25%20front%20cover%20image%20(1).png)

Oliver Watson, director of medical valuation services at Christie & Co, reviews pricing trends within the UK dental market

Our recent Dental Market Review 2025 report included analyses of the prices paid for dental practices across the UK, comparing associate-led with owner-operated businesses, and a range of practice types.

Here are some of our key findings.

AVERAGE DENTAL PRACTICE VALUES

2024 was a year of recovery in transactional volumes.

However, a negative price index in 2024 – a decline of 9.6% in the average price of assets sold – was the product of a higher number of smaller dental practices and corporate disposals sold throughout the year.

Encouragingly, though, H1 2025 saw a vast increase in the average value with a price movement of +2.9%, suggesting the market is entering a new phase of measured growth and resilience, with pricing stabilising and competitive dynamics returning, albeit more selectively than in the aggressive post-pandemic years.

Looking ahead, we expect EBITDA multiples for associate-led practices to remain stable, with potential for upward movement

We expect to see an upward pricing trend as market activity increases.

The dental market has passed its cyclical trough and is showing signs of sustained recovery.

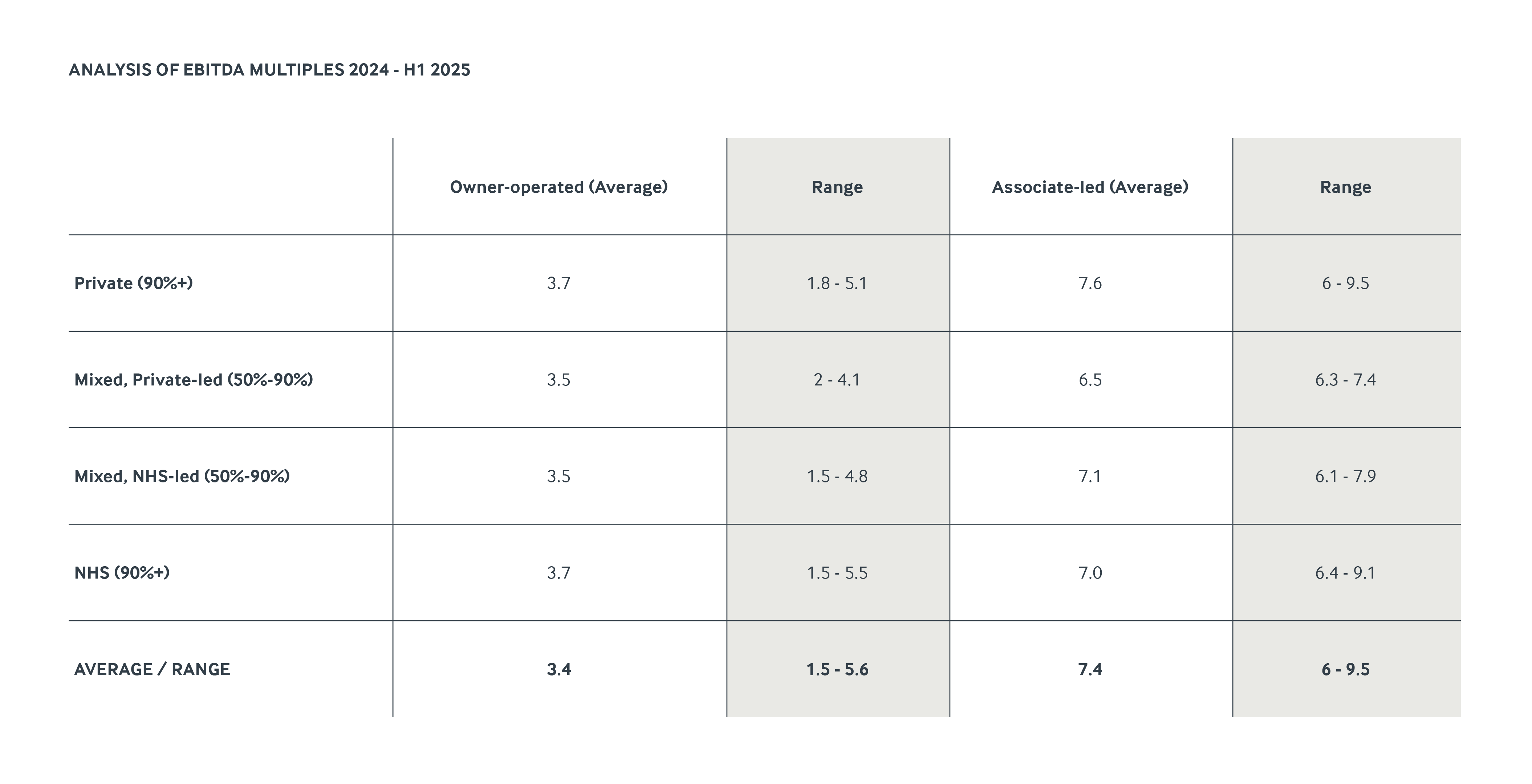

THE EBITDA MULTIPLES ACHIEVED AT COMPLETION

Our analysis of Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) includes a diverse mix of practice types and geographies, which is reflected in the broad range of multiples achieved.

Our findings suggest that, following a period of softening, valuation multiples have largely stabilised.

While mixed practices have experienced a modest downward adjustment in pricing, this shift has been relatively minor.

In contrast, valuations for fully-NHS and fully-private practices have remained resilient, continuing to attract strong buyer interest.

Looking ahead, we expect EBITDA multiples for associate-led practices to remain stable, with potential for upward movement.

This outlook is supported by a growing pipeline of opportunities aligned with the associate-led model and sustained buyer appetite for these types of practices.

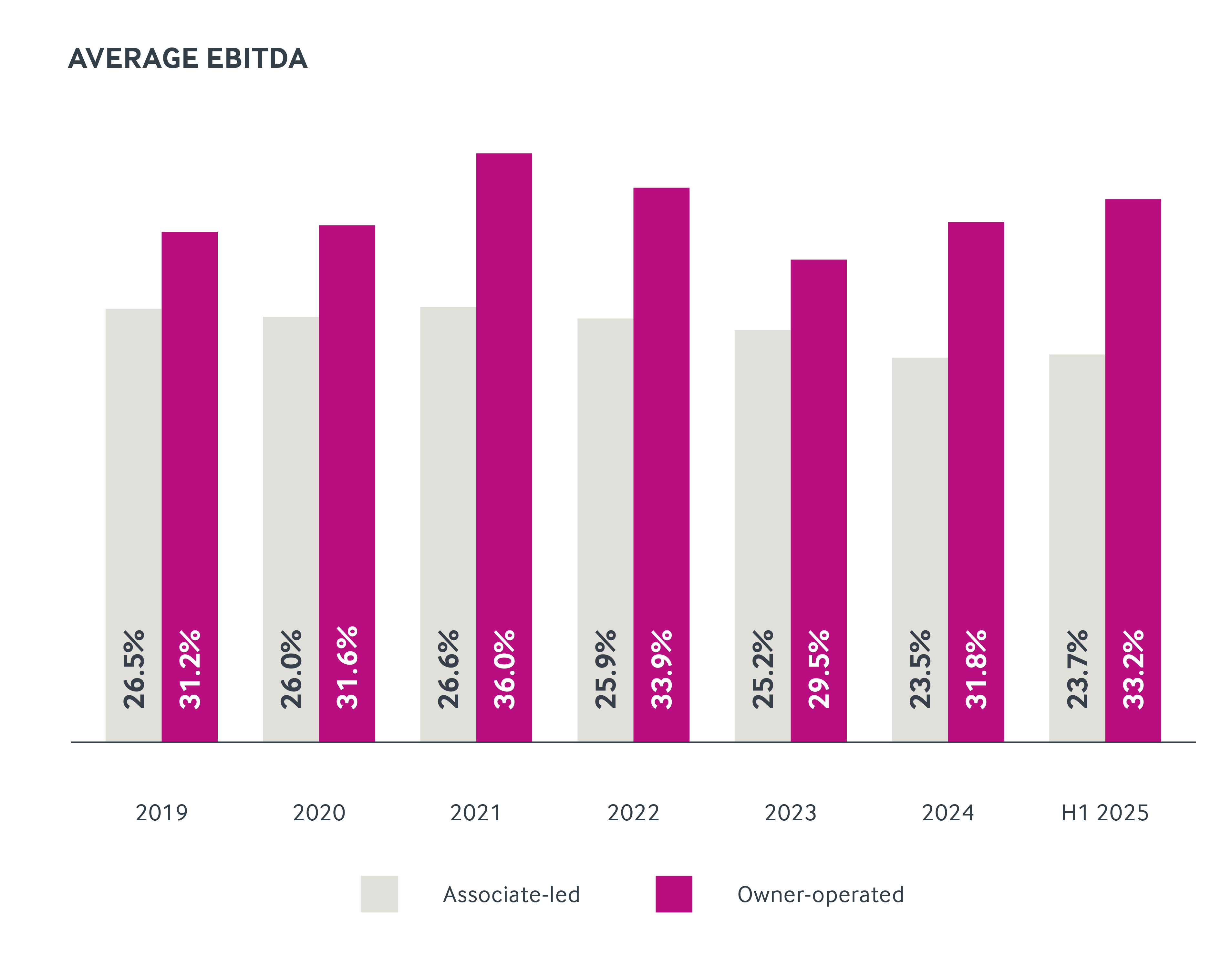

AVERAGE EBITDA

The UK dental market continues to evolve, and 2025 marks a further recalibration in how practices are valued.

While group dental practices once commanded a clear premium, driven by scale, operational leverage, and arbitrage potential, this valuation gap has continued to narrow.

Recent data shows the EBITDA multiples for single-site and group practices are converging, with the premium once paid for group platforms becoming less pronounced.

For sellers, particularly those operating private or private-led practices, the current market offers strong opportunities to capitalise on buyer appetite

Buyers are increasingly focused on underlying profitability, operational resilience, and clinical sustainability, rather than scale alone.

The distinction between private and mixed practices has also blurred.

In 2025, private practices are achieving equal or higher multiples than their mixed counterparts. This is largely due to:

- Owner-operated practices, while continuing to deliver strong EBITDA margins (33.2% in H1 2025), are also achieving higher valuation multiples, reflecting the dominance of independent operators in the current market landscape along with future growth opportunities

- Associate-led models have seen an improvement in EBITDA margins, rising to 23.7% in 2025, as operators become increasingly adept at cost control, reflecting a broader shift toward operational efficiency in response to ongoing economic pressures

- Ongoing recruitment difficulties continue to constrain the operational capacity of NHS-led practices, limiting their ability to meet contractual obligations and maintain service levels

- Buyer appetite is increasingly skewed toward practices with private income streams, which offer enhanced pricing autonomy

- Consumer demand continues to shift towards elective and cosmetic dental treatments – services predominantly delivered within private practice settings – driving further interest in this segment of the market

London and the South East remain the highest-value regions, with associate-led practices in London achieving EBITDA multiples as high as 7.7x, on average.

It has continued to see exceptionally-strong demand and improved multiples, compared with other regions.

Buyers are increasingly attracted to practices offering clear growth potential, particularly those with unutilised surgeries or opportunities to extend opening hours and widen the services provided.

Practices with solid underlying NHS contracts remain highly sought after, especially where there is scope to develop and expand the private element under a new, motivated owner.

For buyers, especially consolidators and private equity-backed groups, the focus is shifting toward quality over quantity, targeting practices with stable teams, strong local reputations, and room for growth

This blend of stability and potential continues to drive competitive bidding and confidence across the London marketplace.

For sellers, particularly those operating private or private-led practices, the current market offers strong opportunities to capitalise on buyer appetite.

For buyers, especially consolidators and private equity-backed groups, the focus is shifting toward quality over quantity, targeting practices with stable teams, strong local reputations, and room for growth.

As buyers re-enter the market, we expect average multiples to increase with competition.

Deferred price is likely to also increase as higher revenue practices are acquired with the re-emergence of corporate buyers.

Years’ tie-in is likely to remain flat as onerous exit terms are unattractive to sellers, likely to sell to an alternative buyer, even at a price cut.

.jpg?width=600&name=Untitled%20design%20(95).jpg)

-2.jpg?width=600&name=Untitled%20design%20(55)-2.jpg)